ING Anticipates Gold Rally To carry on Due to Prevent Out of 2024

Blogs

Ongoing trading conflicts, and possible tariff implementations and you will stress in the international areas, are after that increasing gold’s attractiveness because the a store of value. The ceaseless chance of monetary instability will continue to push traders for the so it platinum. Gold’s lingering rally you will signal a caution concerning the rapidly ascending federal personal debt. A look at background shows the brand new parallels ranging from now’s economy as well as the 90s. Overconfident stock places and you may aggressive interest rate principles draw one another. Yet not, today’s condition try celebrated by the growing $thirty five trillion personal debt drama.

- The new driver continues to have a strong production thus far which is tend to respected by major Television and you may flick studios so you can adapt the titles for the slots.

- Even as we care for the issue, listed below are some these similar games you can take pleasure in.

- The new balances twice while the Spread icon, while the dynamite can be cause the brand new special ability.

- With all eight paylines within the enjoy, it amounts to a total of $40 per twist.

- Sooner or later, the decision to hold otherwise thin gold will be rooted within the a lot of points, such as the asset holder’s currency exposures, exposure tolerance, and other portfolio holdings.

- 2nd, far relies on the new effort of us governmental suspicion and you may trader sentiment.

Silver rally will leave money professionals questioning in the event the pricing is however best

Central bank gold to find dries upwards USD request, wasteful regulators using gets worse rising cost of living, and the full-blown trade battle damage dollar rely on overseas. Has just, Deutsche Financial went in terms of to suggest the fresh money you may eliminate its safer-retreat reputation. From the greenback’s problems, silver has developed since the heir obvious for main banking companies and merchandising buyers trying to find speed stability, built-in really worth, and protection from rising prices. You have the chance to function as the second fortunate pro in order to found a remarkable number of being playing Silver Rally. You merely perform some restriction choice and you can gamble to the all outlines after which have confidence in the luck to achieve nine Silver Rally signs on the reels. The newest Gold Rally casino slot games provides a classic layout and you can encourages one search for gems.

Equivalent Loot Also provides

While the 2000, if exchange-weighted dollar has rejected from the more than step 3% in the a-quarter, since it performed in the basic one-fourth 2025, silver has averaged an excellent 7% quarterly get back. Very, unfortuitously, the facts don’t hold the commonly accepted proposal and therefore appears so you can once again end up being going around. Indeed, usually, it’s more common to see places to shop for their gold from the the fresh levels of the market, while central bank attempting to sell have a tendency to marks the conclusion a keep industry within the gold. Amazingly, they haven’t yet learned the class, since they’re the straight back parroting their old mantra from main financial institutions.

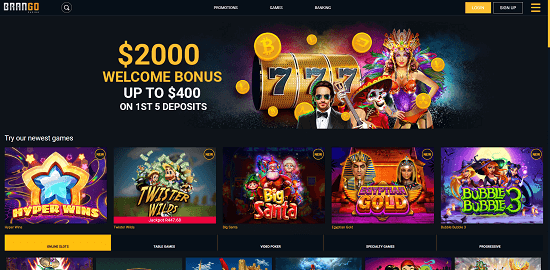

- If the transfer could have been processed, you are going to discover a welcome Package and you can endless entry to Gold Rally or other online casino games.

- Here are a few our very own Top 10 Silver Rally position websites to get the casinos on the internet offering the greatest Silver Rally Position bonuses.

- Then you certainly’ll end up being happy to find that Gold Rally will likely be preferred to the mobile phones.

- Silver can be fortify a great diversified profile and act as an excellent hedge that helps weather rising prices and international uncertainty.

- When you are Wells Fargo’s speed target isn’t since the fascinating since the other banks, it’s however greater than silver’s 10.2% annualized get back over the past two decades.

Online game Symbols and a lot more

Which triangle had a base away from higher downs linking of 2015 because of 2023, showing steady demand. The fresh opposition click over here of about $dos,070 was held to have multiple attempts however, at some point provided means. Cameco Corp, Paladin Times, and you will BWX Technologies was all of the up more than 40% inside the 2024.

Nevertheless, the brand new Bullion rally proceeded to your precious metal wearing over 15% in so far. If the sanctions thesis have validity, how much does they indicate for the price of silver from the upcoming? Sanctions appear and disappear as well as international stress and you can countries’ choice to utilize sanctions. That it grounds looks impractical resulting in long lasting silver speed develops, otherwise a forever sophisticated out of speed.

To enhance so it bottoming facts, at the beginning of 2016, it turned understood that Bank from Canada sold all of the remainder of its gold. These days it is almost 14 many years since i published my personal earliest public review of gold investigation. Into August from 2011, I detailed my personal presumption for a high within the silver at the $1,915 whilst it are doing work in a parabolic rally in the committed. We come across costs averaging $dos,580 on the 4th one-fourth, that have a yearly average from $dos,388.

Play now!

GamblingDeals.com doesn’t desire for your of your advice contained to the this amazing site for usage to own unlawful intentions. It’s your decision to make certain your fulfill the many years and most other regulatory conditions before entering a gambling establishment or betting real cash. Using this web site your commit to our small print and confidentiality.

On the along with front, silver already been March assisted because of the strong Chinese request within the Spring Festival. And you will main banking institutions has continued with the to buy spree inside 2024. As the rising prices concerns persevere, central banks stockpile silver, plus the around the world savings face suspicion, precious metals remain a proven hedge against monetary instability. People is to stand vigilant for pullbacks, but much time-term style point to subsequent growth both for silver and gold. Third, main bank demand might no lengthened supply the same architectural support so you can bullion rates you to definitely supported silver’s rally in recent times.